Small businesses have limited budgets. They need to make sure that they meet their expenses without the need to fall into a debt trap, and still earn some amount of profits. Financial management is an essential component when running a business. Every business owner is looking for a financial consolidation solution, that will cost him less and provide more productivity and deeper analysis of business finances.

Many people rely on manual financial consolidation processes. However, manual work is not only time taking but also prone to errors. A little mistake in the finances of a business can cost heavily. Therefore, there is no room for mistakes when managing your business numbers.

A spreadsheet is another method to manage the financial situation of your business. This is comparatively easier and may offer better management of data. However, the biggest disadvantage of using spreadsheets is that you can not get a deeper analysis of your business data. For the smooth running of the business, you need to keep an eye on your progress regularly.

Having financial consolidation software is the best thing you can do for your business management. Such software can help you draw an analysis of your business data, and help you make better and more informed decisions. Now the question arises, how to find the best software for your business? Here are a few tips to find out.

Dexterity Of The Software

Choose the software that has the intelligence to mold itself into your business requirements. Having tailored software can manage your business processes in a customized manner. The speed with which software can manage your business data and compare it with the international business standards determines the quality of that software.

Better Integration

The software you choose should allow you to better integrate your multiple-faceted business. It may be possible that your business has multiple subsidiaries. While managing finances, you have to look into each subsidiary individually, and then analyze them collectively. Your financial consolidation software should be able to do that to make your tasks easier.

Multiple Analytical Methods

The software you choose for your business should analyze the data using different techniques. It should be able to add all the finances, draw comparative pie charts and graphs and also draw conclusions of your progress. Some software is smart enough to predict the future of your financial landscape. Such software can be an investment rather than a liability.

Automation

The automation of the software is important to make your work easier. The software you choose must be able to automatically prepare data for analysis, draw comparative reports and increase accuracy along with reduced processing time. You can get your financial department trained from https://www.cpmview.com/ to make your financial consolidation much easier and error-free. Your financial management staff should be well-trained and equipped to run the consolidation software and understand its analytical reports and conclusions.

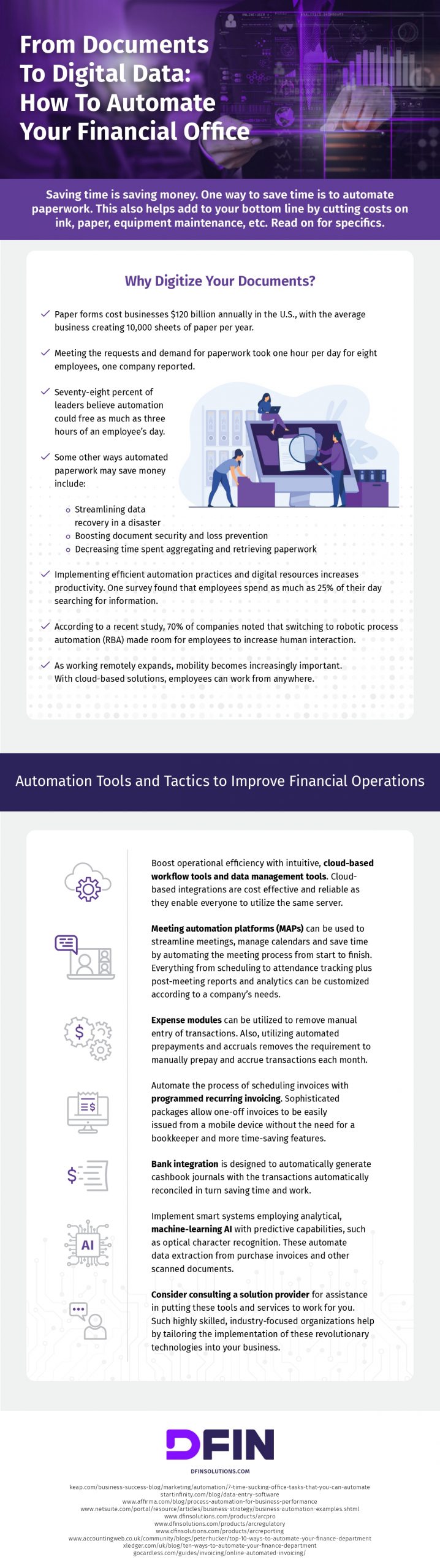

Infographic created by DFIN, a financial compliance software company

Follow Business Blogger for more!